form p partnership malaysia

Definition of a Partnership. Individual partners have to each declare their share of income in their respective Individual Income Tax Returns.

Free Notice Of Restaurant Partnership Dissolution Template Google Docs Word Template Net Letter Templates Confirmation Letter Job Description Template

Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses.

. Some of the unique features of a Limited Liability Partnership includes. Business losses brought forward. 603-89111100 2019 CP3 - Pin.

A Limited Liability Partnership is a hybrid version of the conventional partnership and a Private Limited Company Sdn. Tax Treatment of LLP. 3 Guidelines for completing this form.

4 The use of e-Filing e-P is encouraged. The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. For this you will need to fill the form titled Form PNA42 You will need to list three names for the SSM to choose from in the order of priority.

A refer to the Explanatory Notes before filling up this form. However LLP with capital contribution of RM25 million or less will enjoy a preferential tax rate of 19 on the first RM 500000 of its chargeable income. 603-77136666 2018 YEAR OF ASSESSMENTForm CP3 - Pin.

The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. Departure from Malaysia for a Period Exceeding 3 Months an employer is required to notify the IRB of departure of an employee most of the case will be expatriate from Malaysia for a period of. From above it doesnt look like Fitstar is a non-profitable Partnership Business in Malaysia after all as it is in fact a very profitable venture as opposed to a net loss of RM 10000.

2 Submission through e-Filing e-P can be made via httpsmytaxhasilgovmy. Similar to English Partnership Act 1890. Form P refers to income tax return for partnerships.

The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. Income tax return for individual who only received employment income. Income tax return for individual with business income income other than employment income Deadline.

Two 2 types of businesses. 2019 P FormLEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF PARTNERSHIP UNDER SUBSECTION 861 OF THE INCOME TAX ACT 1967. Board of Valuers Appraisers and Estate Agents Malaysia.

Income tax return for partnerships. Other States1 July 1974 Act A240 PART I PRELIMANARY Short title 1. Limited liability protection to partners.

Partnership Law in Malaysia Principles and Cases 2. Statutory income from all businesses and partnerships. 5 For further information please contact Hasil Care Line- Hotline.

1-800-88-5436 LHDN Calls From Overseas. LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally. Business owned by two or more persons but not exceeding 20 persons.

The deadline for filing Form P by a partnership excluding limited liability partnerships LLPs is by 30 June of the following year. 192-219 of the Contracts Malay States. Income tax return for partnership.

Please access via httpsezhasilgovmy. E-Filing of Form P will be available from 1 Feb. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period.

The responsibilities of the precedent partner include the following. 03-89111000 Calls From Overseas. An identity card name is not allowed to be used as a business name such an entity.

A partnership in Malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the SSM by following the above mentioned rules. Identity card name cant be used as business name. Guidelines f or Business Name Application.

5 For further information please contact Hasil Care Line- Toll Free Line. B Failure to furnish Form P on or before 30 June 2021 is an offence under paragraph 1201d of the Income Tax Act 1967 ITA 1967. Lower income tax rate.

In this Act bankruptcy means a being the subject of an order of. In West Malaysia the Certificate of Registration is valid for one year from the date that was registered and it can be renewed on an annual basis. Only a local Malaysian or Permanent Resident PR is allowed to register a Partnership to run their business.

4 The use of e-filing e-P is encouraged. If a partnership e-Files the Form P by 28 Feb the partnership allocation will be pre-filled in the respective partners Form BB1. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN.

Statutory income from rents. Partnership Law in Malaysia 1. Statutory income from employment.

Exempted from lodging audited financial statement. Business wholly owned by a single individual using personal name as per his her identity card or trade name. File Form P by the filing due date.

Prior to 1974 law on partnership in Malaysia was found in Chap X ss. Inform all the partners of their share of income from the partnership. This Act may be cited as the Partnership Act 1961.

LHDNM has to be notified in writing in case of any amendment to the Form P already submitted. The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted.

A partnership is a business entity owned by two 2 persons but not exceed to twenty 20 persons at one time. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted. 30042022 15052022 for e-filing 5.

30062022 15072022 for e-filing 6. Partnership 7 LAWS OF MALAYSIA Act 135 PARTNERSHIP ACT 1961 An Act relating to partnership. IWe the undersigned hereby apply for the renewal of myour authority to practise valuationappraisalestate agencyproperty management as a firm which expires on 31 December 20.

In Sabah the Trading License is valid until the 31st of December of each year from the date that. Step 2- Registering your business name. The registration of a local business can be completed at any of the SSM offices but investors also have the option of registering it using an online portal the.

Once you gain approval you may submit the form along with the form needed in. Sources of Partnership Law in Malaysia The law of partnership governed by the Partnership Act 1961 Revised 1974. The renewal fee is RM25 and there will be an additional fee of RM1 for each of the branch.

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. With this pre-filling initiative the precedent partner need not separately inform the respective partners of their share of the partnership income and the individual partners can enjoy the convenience of having.

2018 P LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF PARTNERSHIP. Please access via httpsezhasilgovmy.

Letter Requesting Transfer To Trust Accounting Services Legal Forms Free Printable Letters

Letter For Authorizationfind Here An Example Of Sample Authorization Letter To Download In Doc Format Lettering Rental Agreement Templates Contract Template

Sample Incident Report Letter Word Incident Report Form Incident Report Good Essay

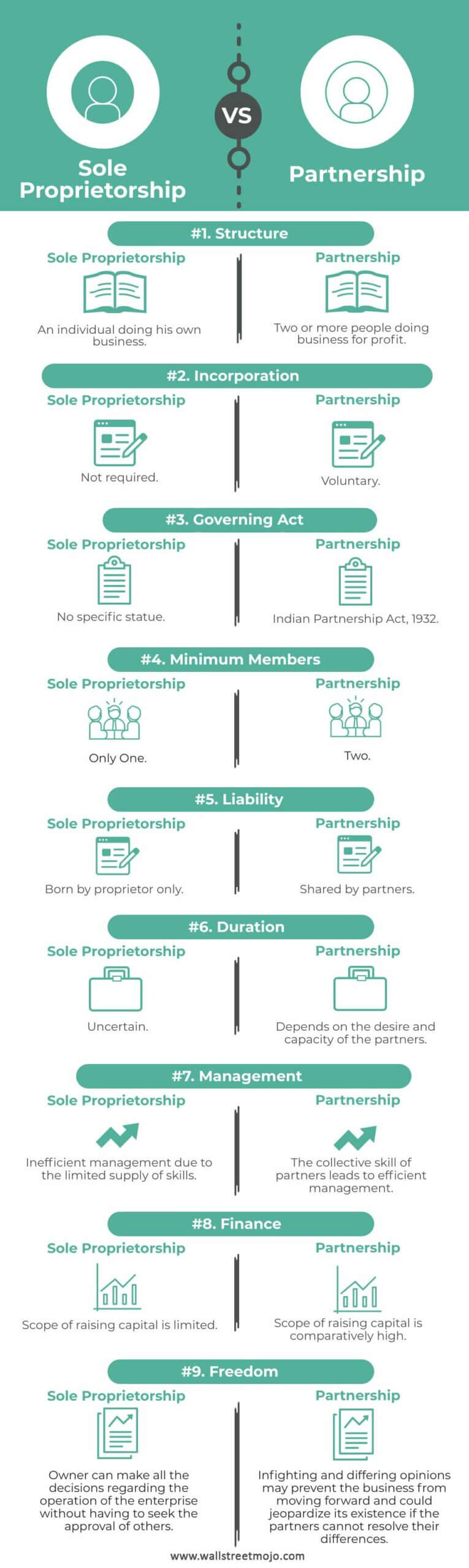

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Business Income Tax Malaysia Deadlines For 2021

Simple House Rent Agreement Format In Word Rental Agreement Templates Words Contract Template

4 Sample For Authorization Letter Format Lettering Letter Format Sample Lettering Download

The Major Benefits Of Outsourcing Your Development Needs Development Web Development Outsourcing

Sample Apartment Lease Agreement Form In Word Apartment Lease Lease Agreement Rental Agreement Templates

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

Sample House Rental Agreement Malaysia Template Doc And Pdf Rental Agreement Templates Being A Landlord House Rental

Example Of Simple Rent Agreement Format Word Template To Print For Free Words Being A Landlord Rental Agreement Templates

Regional Comprehensive Economic Partnership Rcep And India Region Partnership Economic Goods

House Rental Agreement Word Doc Rental Agreement Templates Microsoft Word Document Word Doc

Pin By Bryan Lee On Design Asia Style Chinese Korea Japan Chinese Art Art Forms Scenic

Chief Marketing Officer Resume Fresh Council Post Key Marketing Elements The Most Powerful

No comments for "form p partnership malaysia"

Post a Comment